(212) 398-3700

(212) 398-3700

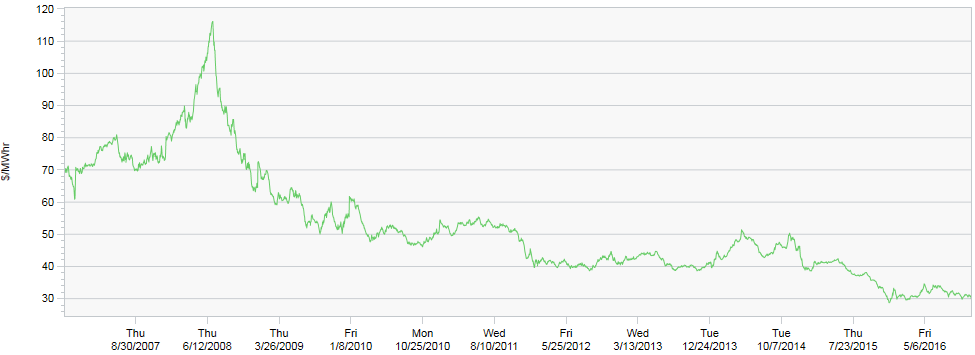

New Jersey is often perceived to be a high power cost location relative to mid-Atlantic locations such as Northern Virginia. While historically this notion was rooted in fact, massive structural changes in the market for natural gas commencing in 2008 have upended this reality. Electric rates in New Jersey’s PJM power pool are heavily influenced by the commodity price of natural gas and as natural gas prices plummeted in 2008, due to newfound American shale gas resources, so too did the cost of New Jersey electricity.

Prompt Year PSEG (NJ) Wholesale Power Prices ($/MWhr)

The punchline: Sentinel NJ-1’s all-in power rate is $0.068 per kWh including tax (last-twelve-month average), a rate at or near those of the regulated utilities that serve the vast majority of Northern Virginia’s data center industry. As a result, there is no longer a material power-cost penalty to locating in close proximity to New York City’s vibrant business eco-system.

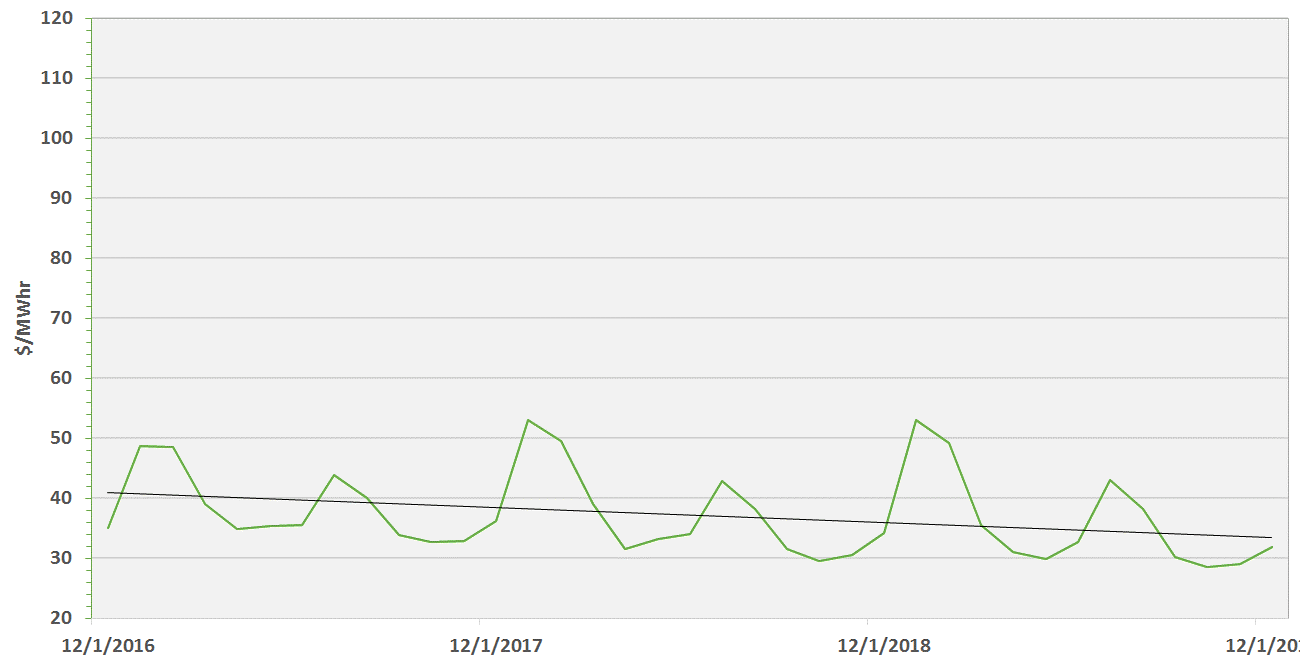

Even better news, all serious forecasts indicate that this new reality of low natural gas pricing and resultant low power pricing in New Jersey is here to stay. As detailed below, current futures pricing on forward purchases of New Jersey power (in the PSE&G service territory) actually indicate a slightly downward trend through 2020 (with only normal seasonal variation).

PJM Futures Curves

In fact, there are structural reasons why we believe New Jersey rates may continue to fall relative to Northern Virginia. The fuel supply mix for electricity production in NJ is far more reliant on natural gas and nuclear inputs than that of Virginia which is far more reliant on coal. For example, coal-based generation accounts for ~45% of Virginia’s power relative to only ~21% in NJ. Given coal-based power production produces over twice the carbon emissions as natural-gas based production and more than tenfold the emissions of nuclear production, Virginia’s rates will likely face upward pressure as environmental concerns and regulations continue to motivate the retirement of coal-based plants.

The longstanding conventional wisdom that New Jersey is an expensive power market relative to its regional peers runs counter to the facts of the last five years. For those seeking proximity to the NYC-area’s vibrant business eco-system, workforce and financial markets, there’s never been a better time to deploy data center capacity in New Jersey.